amazon flex take out taxes

Choose the blocks that fit your schedule then get back. Stride is a cool and free new option for mileage tracking.

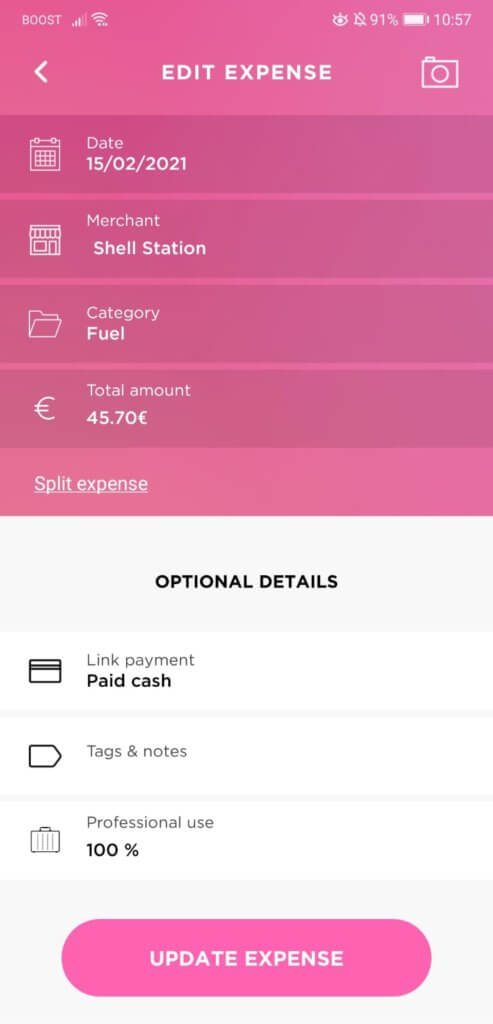

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

This app makes keeping track of my tax deductions a breeze.

. However Amazon Flex pay averages 18 to 25 per hour when you include tips. Does Amazon Flex take out federal and state taxes. Whatever drives you get closer to your goals with Amazon Flex.

June 3 2019 1217 PM. You are going to owe 154 ss and medicare taxes on that 4700 which comes out to around 724. Amazon Flex does not take out taxes.

Beyond just mileage or car expenses getting a 1099 from Amazon means that you can claim a lot of other expenses as tax write offs -- the phone. Amazon Flex drivers receive 1099-NEC forms from the company according to online reports. Whether youre saving up for that dream car or simply finding creative ways to make ends meet Amazon Flex could be a great way to earn some extra income.

Yes they do everything. There are plenty of gas rewards cards that pay at least 1 to 2 cash back when you refuel. In fact there are numerous ways Flex drivers can save money on fuel costs.

Understand that this has nothing to do with whether you take the standard deduction. Self Employment tax Scheduled SE is generated if a person has 400 or more of net profit from self-employment on Schedule C. Sign out of the Amazon Flex app.

Maybe you guess that your average is so many miles per day. Tips factor into your income making it hard to determine. Its gone from a chore to something I look forward to.

My question is as follows in relation to Amazon Flex and claiming mileage. Tap Forgot password and follow the instructions to receive assistance. Lets take a closer look at what this means.

You can plan your week by reserving blocks in advance or picking them each day based on your availability. With Amazon Flex you work only when you want to. And Amazon pays you 25 an hour so 100 for the whole block.

Amazon Flex drivers can expect to receive a 1099 form from the Amazon company if they earned at least 600 working for the service within the tax year. You receive a 1099. If you have records of oil changes and other car maintenance maybe you can figure out the average miles per month you drove before becoming an Amazon driver and the average number of miles per month after and the increase is probably your work miles.

Income tax starts at 20 on all your income not just from amazon over 12500 and 40 over 50000. If you dont have other tax withholding that covers your tax liability you will need to make quarterly tax payments. No You are an Independent Contractor.

So you make 100 for 3 hours of work increasing your rate from 20 an hour to around 33 an hour. This video shares information on where to find your 1099 expenses you should take into account to reduce your taxable i. Since its debut in 2015 Amazon Flex has launched in over 50 cities across the United States.

Watching my deductions grow. It offers an automatic system that detects when youre driving so you can be sure to log every mile. Look into paying estimated taxes because none is being withheld -- or the IRS will get testy with you read.

I have recently started doing part time work with Amazon Flex this basically for tax purposes makes me a self employed contractor. You pay 153 for 2014 SE tax on 9235 of your Net Profit greater than 400. Fine you in the spring because youll be under-withheld.

Amazon Flex is a courier service for you guessed it Amazon. I already work a normal 9-5 job and pay tax and NI through PAYE. I am aware that being classed as self employed means I will need to fill.

When you fill in your tax return online HMRC will automatically calculate how much. The 153 self employed SE Tax is to pay both the employer part and employee part of Social Security and Medicare. Your mileage comes right out of income on your 1099 before you take any deductions.

If you still cannot log into the Amazon Flex app please contact us at 888-281-6906 daily between 8 am. Asked October 10 2017. You can make closer to 25 per hour by using a larger car which makes you eligible to deliver more packagesAnother option is to claim blocks during busy.

Driving for Amazon flex can be a good way to earn supplemental income. Its almost time to file your taxes. The pay for Amazon Flex drivers depends on the area and type of delivery you make.

Knowing your tax write offs can be a good way to keep that income in your pocket. Answered December 24 2017. Amazon says it always pays you at least 15 19 per scheduled hour.

Welcome to the AmazonFlex Community where AmazonFlex Drivers come together. Adjust your work not your life. 1099 Forms Youll Receive As An Amazon Flex Driver.

12 tax write offs for Amazon Flex drivers. If you have a W-2 job and do Amazon Flex for extra money you can increase your withholding at your main job instead of paying quarterly taxes. We know how valuable your time is.

Youre an independent contractor. The forms are also sent to the IRS so take note if youve made more than 600 in the relevant tax year. Class 2 National Insurance is paid as a set weekly amount when your earnings go over 6475 and Class 4 is worked out as 9 on your earnings over 9501.

Answered December 2 2017 - Amazon Delivery Driver Current Employee - Chicago IL. Use A Gas Rewards Card. But instead of it taking you four hours to make all of your deliveries you managed to make them in three hours.

Select Sign in with Amazon. Then youll owe your normal tax rate on the 4700 as well. One of the simplest ways to save money on gas as an Amazon Flex driver is to use a rewards credit card when refuelling.

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

19 Tax Write Offs For Social Media Influencers In 2021 Tax Write Offs Office Necessities Creative Apps

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How To File Amazon Flex 1099 Taxes The Easy Way

Delivery Driver Tax Deductions Doordash Grubhub Uber Eats Instacart

Amazon Flex Be Your Own Boss Great Earnings Flexible Hours Be Your Own Boss Work From Home Moms Extra Money

![]()

Irs Uber Mileage Log Tax Deduction With Triplog Tracking App Tax Deductions Tracking App Mileage

How To File Amazon Flex 1099 Taxes The Easy Way

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

How To File Taxes As An Independent Contractors H R Block

Does Amazon Flex Take Out Taxes In 2022 Complete Guide

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

How To Do Taxes For Amazon Flex Youtube